For some time I have targeted the 396 level, to be followed by a move the 406-411. SPY spent most of the past two weeks bouncing around the 402-392 level. On Friday we did see SPY finally break above that 402 level. When last I posted, my current count from the 418.31 high was this:

SPY had moved slightly below the level at which I was expecting to see a move higher. The action from the 21st to the 24th was choppy, and difficult to follow at times. Now that it has resolved itself I can revisit this count, and see where we are. After reviewing the count further, I was able to clarify some of the action, and show a slightly revised count here:

The major revision involved seeing Wave E(Purple) as a more extended wave that ended on the 23rd at 402.20. Waves 3,4 and 5(Purple) then completed on the next move lower to 396.25, completing Wave D(Green). From there we can walk through the rest of the count. Wave 1 (Green) completed at 408.51. Wave 2(Green) then completed as an inverted corrective wave, which broke down into A-B-C-D-E, giving us 408.51 - 413.65 - 409.47 - 414.00 - 396.25 - 401.62. Analyzing the sequence (418.51, 413.65), (409.47, 414.00), (396.25, 401.62) gives an R^2 value of .99837.

We can now see that the Green 5 wave sequence completes as 415.05 - 408.51 - 401.62 - 393.64 - 401.29 - 392.33. (415.05, 408.51), (401.62, 393.64), (401.29, 392.33), gives an R^2 value of .99731.

The completion of that sequence is Wave D(Red). Given the four competed waves of this sequence, A-B-C-D(Red), we can now calculate the range in which Wave E(Red should complete. SPY has already entered into that range, with the maximum of that range being 411.19. That level may be an important one, as I will explain.

The above count calls for a high between the the current price levels and 411.19, to be followed by three waves down to complete the 5 wave sequence from the 418.31 high. There is an intriguing alternate count which I will discuss now.

In the current count Wave B(Red) completed on the 10th at 405.01. From that point there are 5 counted waves to the 414.00 high on the 15th. I am currently counting these as Wave C(Red), Wave 1(Green), and Waves A-B-C(Green). This still seems to be the best count, but there is an important alternate count to consider. I currently show the first wave from Wave B(Red) completing at 415.05. A case could be made for that wave having completed slightly earlier, at 412.97, followed by a complex corrective wave to 408.51. Taking that as the high gives the sequence from 405.01 as 405.01 - 412.97 - 408.51 - 413.70 - 409.47 - 414.00. (405.01, 412.97), (408.51, 413.70), (409.47, 414.00), with an R^2 value of .99343. That would put the Wave C(Red) endpoint at 414.00.

This shows the alternate count using 414.00 as Wave C(Red). I filled in the remainder of the alternate count with "?". Continuing with that count we see that Wave 2(Red) completes as 407.57 - 416.49 - 405.01 - 414.00 - 396.25 - 401.62. (407.57, 416.49), (405.01, 414.00), (396.25, 401.62) gives us an R^2 value of .99636. The entire 5 wave sequence from 418.31 can then be seen as 418.31 - 407.57 - 401.62 - 393.64 - 401.29 - 392.33. (418.31, 407.57), (401.62, 393.64), (401.29, 392.33) gives an R^2 value of .99632.

It seems that SPY is at an inflection point here, which makes the current price levels extremely important. A move above the 411.19 upper limit I discussed earlier would likely make the alternate count I have discussed the correct count.

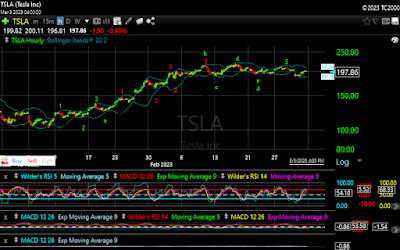

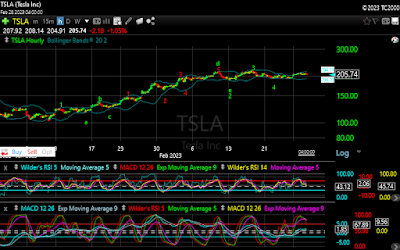

There is some further evidence of a bottom having been put in at 392.33. In my TSLA update yesterday I discussed one method for determining a likely limit for a corrective wave using the previous low, the correction low, and the last two high of the previous wave. The 392.33 low would satisfy that method. SPY has also given a technical buy signal on the daily chart. We will see if those hold over the coming days.